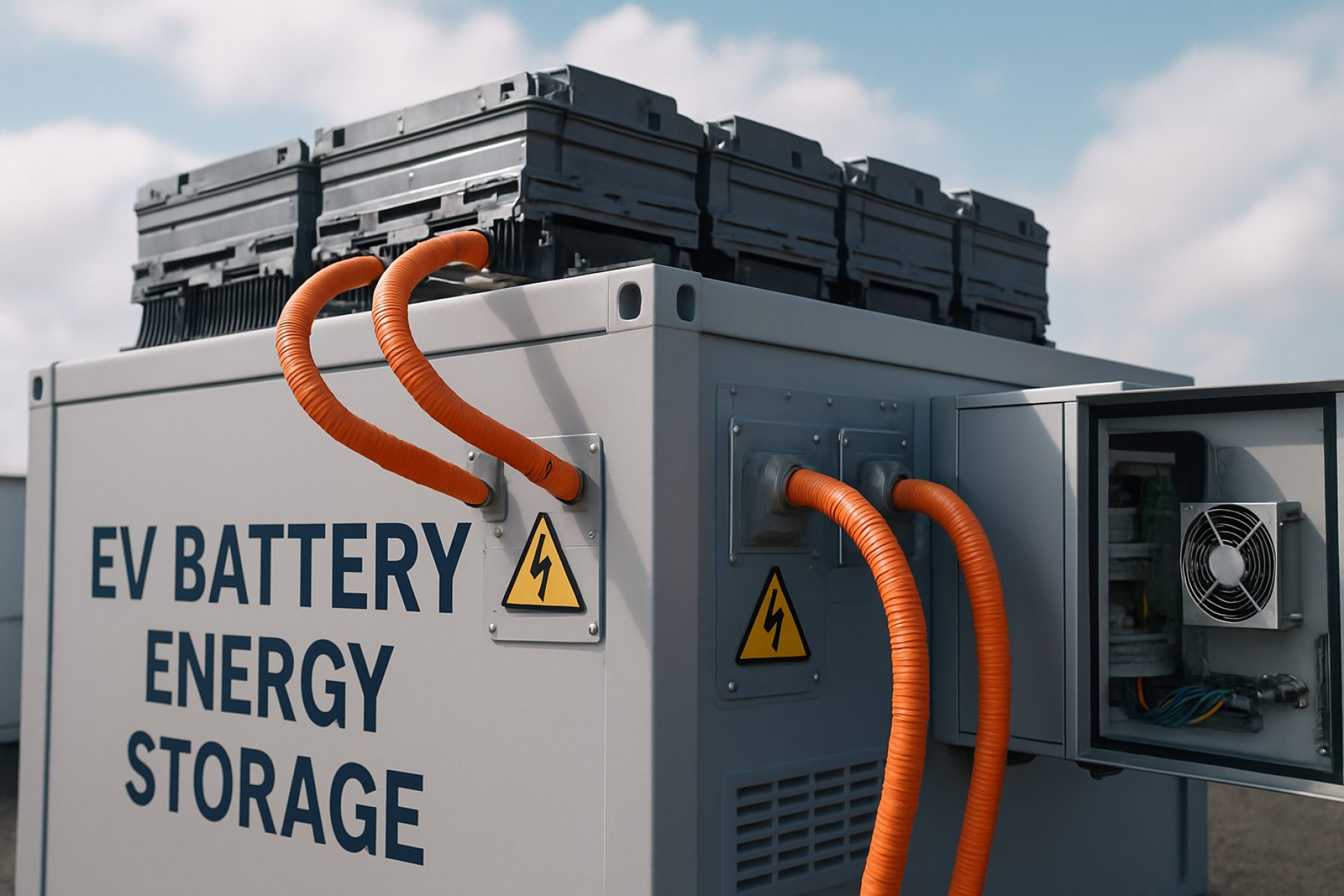

Inside the 2025 EV Battery Energy Storage Boom: Massive Growth, Cutting Edge Innovations, and a Greener Future Await

The global EV Battery Energy Storage market is projected to soar to $38.9B by 2034, with disruptive technologies and green trends fueling demand.

- Market Value 2023: $3.1 Billion

- Projected Value 2034: $38.9 Billion

- Forecast CAGR: 25.6% (2023-2034)

- Top Battery Type: Lithium-Ion

The race to electrify the world is picking up speed, and at the heart of this revolution lies the Battery Energy Storage System (BESS) market for electric vehicles. Global momentum, supercharged by government incentives and relentless battery innovation, is rewriting the rules of transportation. If you thought the EV wave was big in 2023, brace for a tidal surge by 2034.

Fueled by the unstoppable march of clean technology, new government mandates, and relentless demand for sustainable transport, the BESS market promises the kind of exponential growth that investors and industry titans dream about. Key players like BYD, LG Energy Solution, Samsung SDI, and many more, are racing to redefine how we store and use energy on the move.

Q: Why Is The Battery Storage Market For EVs Surging?

The transition to electric vehicles isn’t just about zero tailpipe emissions. It’s a story woven with falling battery costs, fast-charging breakthroughs, and wider EV acceptance from Asia-Pacific to North America. Battery energy storage systems provide the muscle for reliable, long-range journeys—making “range anxiety” a thing of the past.

Governments are sweetening the pot with tax breaks, R&D subsidies, and big investments in EV charging infrastructure. Demand for efficient, eco-friendly travel keeps climbing, pushing both passenger and commercial EV markets into overdrive.

Check out more on government EV roadmaps and technologies at energy.gov and see global EV growth stats from iea.org.

How Are Battery Technologies Powering The Future?

Lithium-ion batteries remain the gold standard—packing massive energy density into surprisingly slender packages, delivering not just longer range, but a longer life cycle. Meanwhile, advances like solid-state batteries and lithium iron phosphate (LFP) are making waves, promising even greater safety and performance.

Top BESS players are pushing technological boundaries, focusing on:

- Higher Energy Density: Maximizing range and minimizing weight.

- Rapid Charging: Reducing plug-in time, keeping EVs on the road.

- Sustainability: Introducing eco-friendly recycling and greener raw materials.

- BaaS (Battery-as-a-Service): Innovative lease models making EVs more affordable for the masses.

Q: Who’s Leading—and How Are They Winning?

Industry titans like ABB Ltd., AEG Power Solutions, GE, Panasonic, and Siemens are setting the pace with strategic partnerships and ambitious global expansions, especially into the fast-growing Asia Pacific region. They’re rolling out eco-initiatives, next-gen batteries, and building networks with automakers and infrastructure giants.

Some are offering BaaS models—swapping battery ownership for leasing, which slashes upfront EV costs and turbocharges adoption.

How To Ride the 2025 EV Battery Revolution

If you’re an investor, automaker, startup, or policymaker, 2025 and beyond offer enormous opportunities:

- Track next-gen battery rollouts and manufacturing expansion in Asia Pacific.

- Integrate battery recycling and sustainable supply chains into your business model.

- Leverage BESS innovations to build competitive EVs or supply chains.

- Capitalize on government incentives and R&D funding for green tech.

Curious about the full market picture? Dive into data-driven research and actionable insights with Transparency Market Research.

Q: What’s Next In BESS Segmentations?

From conventional lithium-ion to solid-state and LFP, the battery segment is diversifying fast. Key vehicle segments include not just passenger EVs, but also commercial fleets and even electric two-wheelers—each with distinct storage solutions and performance demands.

North America, Europe, and Asia Pacific fuel the fastest growth, but expect a surge in Latin America and the Middle East as infrastructure and incentives unlock new markets.

For more about the future of automotive tech, visit GlobeNewswire and the ongoing updates at Tesla.

Your Checklist For The 2025 EV Battery Boom

Don’t Miss The Wave—Here’s How To Prepare:

- Follow top innovators and track new battery breakthroughs.

- Explore strategic partnerships in manufacturing and infrastructure.

- Integrate sustainability at every step.

- Watch for solid-state and BaaS disruptors entering the market.

- Monitor regulatory and incentive shifts in major markets.

Ready to electrify your strategy or investments? Get ahead of the curve by subscribing to trusted market updates and deep-dive reports!